News

CBN Limits Dollar From Bureau De Change To $10,000 For School Fees, $5000 For Medical Bills

News

FIRSTBANK FILES APPEAL

- INJUNCTION AND STAY OF EXECUTION

- CARGO REMAINS UNDER ARREST

In a surprising twist of events, its decision delivered today, the Federal High Court in a surprising shift from the true nature of FirstBank ’s claim held that the matter is not a maritime claim but rather, a simple case of debt recovery. This is quite surprising considering the fact that the order sought is to prevent further fraudulent sale of crude on the FPSO.

Shockingly, the court also held that the Arrest Order against the cargo, because it was exparte in nature, expired by effluxion of time within 14 days of its issuance.

Aggrieved by the decision, FirstBank lodged an appeal against the decision of the FHC. Also, FirstBank filed an application for an injunction of the court against GHL, pending the determination of the appeal. The Cargoes of Crude Oil on the FPSO TAMARA TOKONI remain arrested.

While FirstBank has great respect for the courts, it strongly disagrees with the ruling, which, in our view, constitutes a miscarriage of justice.

FirstBank remains committed to protecting and securing the interest of its members and will relentlessly pursue justice against mischievous debtors seeking to use the machinery of the law to perpetuate mischief and evade their responsibility to offset outstanding obligations.

About FirstBank

First Bank of Nigeria Limited “FirstBank”, established in 1894, is the premier bank in West Africa, a leading financial inclusion services provider in Africa, and a digital banking giant.

FirstBank’s international footprints cut across three continents ─ Africa, Europe and Asia, with FirstBank UK Limited in London and Paris; FirstBank in The Democratic Republic of Congo, Ghana, The Gambia, Guinea and Sierra Leone; FBNBank in Senegal; and a FirstBank Representative Office in Beijing, China. All the subsidiary banks are fully registered by their respective Central Banks to provide full banking services.

Besides providing domestic banking services, the subsidiaries also engage in international cross-border transactions with FirstBank’s non-Nigerian subsidiaries, and the representative offices in Paris and China facilitate trade flows from Asia and Europe into Nigeria and other African countries.

For 130 years, FirstBank has built an outstanding reputation for solid relationships, good corporate governance, and a strong liquidity position, and has been at the forefront of promoting digital payment in the country with over 13 million cards issued to customers (the first bank to achieve such a milestone in Nigeria). FirstBank has continued to make significant investments in technology, innovation and transformation, and its cashless transaction drive has been steadily accentuated with virtually 23 million active FirstBank customers signed up on digital channels including the USSD Quick Banking service through the nationally renowned *894# Banking code.

With over 42 million customer accounts (including digital wallets) spread across Nigeria, UK and sub-Saharan Africa, the Bank provides a comprehensive range of retail and wholesale financial services through more than 820 business offices and over 233,500 agent locations spread across 772 out of the 774 Local Government Areas in Nigeria.

In addition to banking solutions and services, FirstBank provides pension fund custody services in Nigeria through First Pension Custodian Nigeria Limited and nominee and associated services through First Nominees Nigeria Limited.

FirstBank’s commitment to Diversity is shown in its policies, partnerships and initiatives such as its employees’ ratio of female to male (about 39%:61%; and 32% women in management) as well as the FirstBank Women Network, an initiative that seeks to address the gender gap and increase the participation of women at all levels within the organisation. In addition, the Bank’s membership of the UN Women is an affirmation of a deliberate policy that is consistent with UN Women’s Women Empowerment’s Principles (WEPs) ─ Equal Opportunity, Inclusion, and Nondiscrimination.

For six consecutive years (2011 – 2016), FirstBank was named “Most Valuable Bank Brand in Nigeria” by the globally renowned The Banker Magazine of the Financial Times Group and “Best Retail Bank in Nigeria” eight times in a row, 2011 – 2018, by the Asian Banker International Excellence in Retail Financial Services Awards.

In 2022, the Top 100 African Bank rankings released by The Banker Magazine ranked FirstBank as number one in Nigeria in terms of Overall Performance, Profitability, Efficiency and Return on Risk. Also in 2022, the Bank received the “Most Innovative Retail Banking Product in Nigeria (FastTrack ATM)” and “Best Retail Bank in Nigeria” awards from International Finance Magazine. FirstBank was also awarded “Best Corporate Banking Western Africa, 2022” and “Best CSR Bank Western Africa, 2022’’ by Global Banking and Finance Magazine.

Other notable awards in FirstBank coffers include: “Best Bank in Nigeria” by Global Finance magazine – fifteen times in a row; “Best Private Bank in Nigeria-2021” awarded by Global Finance magazine; “Best Internet Banking Nigeria” and ‘’Best CSR Bank Africa’’ by International Business Magazine.

In 2023, FirstBank received notable awards including “Best Private Bank for Sustainable Investing in Africa 2023” by Global Finance Awards; “Best Sustainable Bank in Nigeria 2023” by International Investors Awards; “Best Bespoke Banking Services in Nigeria 2023” by International Investors Awards; “Best Financial Inclusion Service Provider in Nigeria 2023” by Digital Banker Africa; and “African Bank of the Year” by African Leadership Magazine; ’’Best Corporate Bank in Nigeria 2023’’ by Euromoney Awards and ‘’Most Innovative Banking Brand – Nigeria 2023’’ by Global Brands Award.

Other laudable feats in 2023 include FirstBank’s international recognitions on major indices by Euromoney Market Leaders, an independent global assessment of the leading financial service providers where FirstBank was crowned:

Market Leader: (tier-1 recognition) in Corporate Banking,

Market Leader: (tier -1 recognition) in Digital Solutions,

Highly Regarded: Corporate and Social Responsibility (CSR),

Highly Regarded: Environmental, Social and Governance (ESG), Notable: in SME Banking.

Significantly, FirstBank’s Global Credit Rating was A+ with a positive outlook while ratings by Fitch and Standard & Poor’s were A (nga) and ngBBB+ respectively both with Stable outlooks as at September 2023. FirstBank maintained the same level of international credit ratings as the sovereign; a milestone that was achieved in 2022 for the first time since 2015.

Our vision is ‘To be Africa’s Bank of first choice’ and our mission is ‘To remain true to our name by providing the best financial services possible. This commitment is anchored on our core values of EPIC – Entrepreneurship, Professionalism, Innovation and Customer-Centricity. Our strategic ambition is ‘To deliver accelerated growth in profitability through customer-led innovation and disciplined execution and our brand promise is always to deliver the ultimate “gold standard” of value and excellence to position You First in every respect.

Olayinka Ijabiyi

Ag. Group Head, Marketing & Corporate Communications

First Bank of Nigeria Limited

News

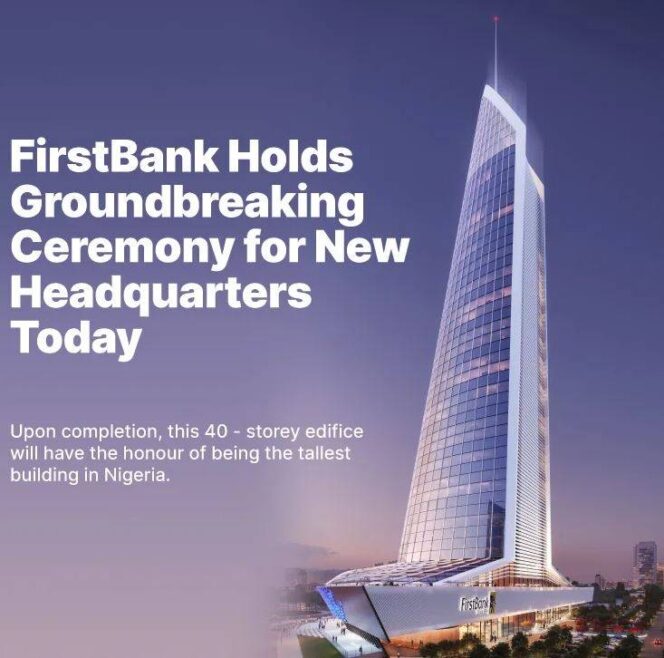

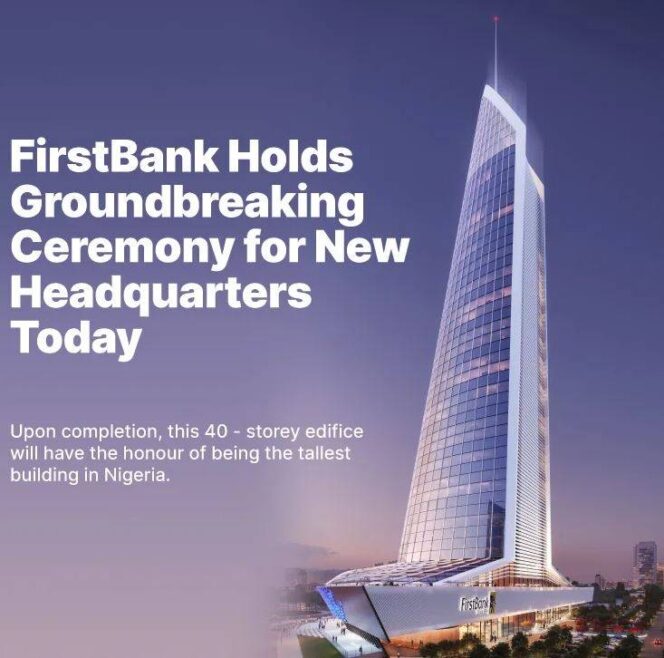

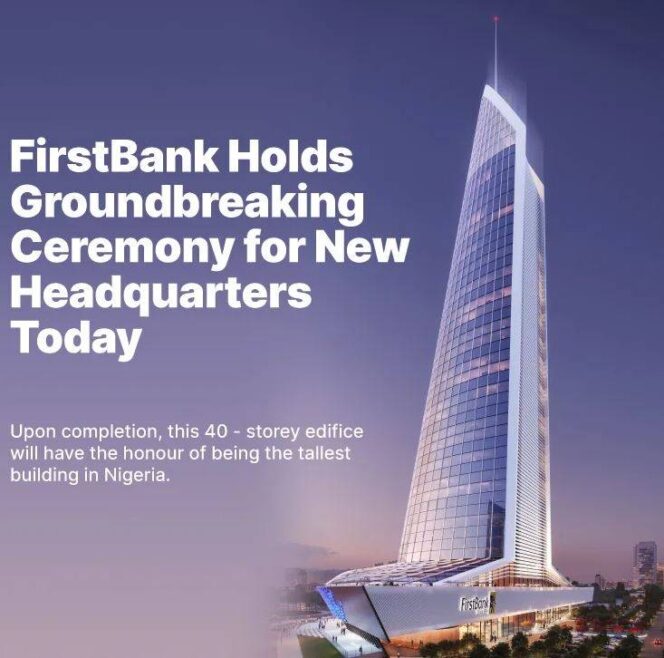

FirstBank holds groundbreaking ceremony for new 40-storey eco-friendly HQs in Lagos

FirstBank of Nigeria Limited, West Africa’s premier bank and a key player in financial inclusion, will today (Wednesday) host the groundbreaking ceremony for its new, green-certified headquarters in Eko Atlantic City, Lagos.

The 40-storey building, set to become the tallest structure in Nigeria, promises to be a technological and environmental marvel, with advanced, eco-friendly construction designed to set new benchmarks in Africa’s financial services sector.

A statement on Wednesday signed by Olayinka Ijabiyi, Ag. Group Head, Marketing & Corporate Communications, First Bank said the ceremony marks the beginning of a transformative journey that highlights commitment to innovation, excellence, and customer satisfaction.

“The new headquarters will feature a sustainable, green-certified design aimed at reducing operational costs while positioning FirstBank as a leader in sustainable banking practices,” it said.

Olusegun Alebiosu, CEO of FirstBank Group, stated, “We are thrilled to reach this important milestone in our pursuit of excellence. Our new head office will be a world-class structure that reflects our dedication to innovation, sustainability, and customer satisfaction. We believe this development will play a key role in driving economic growth and long-term value for all our stakeholders across Africa.”

With a legacy of over 130 years, FirstBank has consistently been a trailblazer in innovation, customer service, and sustainable business practices. The bank operates across nine countries on three continents, reinforcing its international presence.

Femi Otedola, Chairman of FirstHoldCo, remarked, “Today’s ceremony underscores the importance of collaboration and the unwavering support from various sectors in realizing our vision for the new headquarters. We are deeply grateful for the continued support from our customers and stakeholders as we bring this vision to life.”

The groundbreaking event will be attended by distinguished guests, including the President of the Federal Republic of Nigeria, Senator Bola Ahmed Tinubu GCFR, as well as senators, lawmakers, state governors, federal ministers, and key figures from various industries. This event marks the beginning of an exciting new chapter in FirstBank’s rich history, cementing its position as a leader in Africa’s financial landscape.

News

‘No Disparity,’ NUPRC Confirmed 1.8m bopd NNPC Ltd Oil Production Figures At NAPE Conference’

1.54m bopd production figure (quoted by THISDAY for October) is for September, not October,’ What NUPRC boss told highest body of petroleum explorationists and stakeholders in Lagos.

The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) confirmed the 1.8 million barrels of per day (bopd) production figures earlier released by the Nigerian National Petroleum Company Limited (NNPC Limited) at the conference organised by the Nigerian Association of Petroleum Explorationists (NAPE) in Lagos.

This newspaper, which reported the Commission boss, Gbenga Komolafe, to have said this to stakeholders, maintained that the development is contrary to a report making the round that the NUPRC contradicted the NNPC Ltd figures.

Speaking at the 42nd Nigerian Association of Petroleum Explorationists Annual International Conference & Exhibition in Lagos, Komolafe said that Nigeria’s crude oil output, including condensate, increased by 16.56 per cent to 1.8 million barrels per day, bpd in October 2024, from 1.54 million bpd in September 2024.

He said that as a result of this feat, Nigeria has exceeded the 1.5 million bpd quota of the Organisation of Petroleum Exporting Countries, OPEC.”This represents an increase of 253,710,bpd to reach 1.8 million bpd in October, up from 1.54 million bpd in September 2024, representing 16.56 per cent month-on-month rise,” he said.

Represented by Enorense Amadasu, Executive Commissioner for Development and Production at NUPRC, the NUPRC boss declared that efforts were underway to further increase oil output to two million bpd by December 2024.

Highlighting the theme of the conference, “Resolving the Nigerian Energy Trilemma: Energy Security, Sustainable Growth and Affordability”, Komolafe, said the organization is committed to expanding Nigeria’s oil production capacity.

Checks by this newspaper showed that this is the same position of the NNPC Ltd, which said it and its partners have revved up crude oil and gas production to 1.8 million barrels per day (mbpd) and 7.4billion standard cubic feet (bscf) per day.

The company announced this at a press briefing, maintaining that the feat was achieved in compliance with the mandate of President Bola Ahmed Tinubu.This newspaper gathered that these figures are, contrary to misconstrued report, the same with the ones announced by the NUPRC.

Disparity Where There Is None A THISDAY review of the delayed October production figures by the NUPRC, which is the oil and gas sector upstream regulator, claimed that Nigeria produced 1.538 million bpd of crude oil and condensate.

The three-month low production data released by the NUPRC, the report claimed, contradicted the report announced by the national oil company and the Ministry of Petroleum Resources (Oil), which specifically put production at 1.808 million bpd.

Looking Beyond 1.8m bopd, Speaking on the development, the Group Chief Executive Officer, Mr. Mele Kyari, who reiterated that the Company revved up oroduction to 1.8 m bopd, declared the target to even increase the production to 2 million bopd.

Kyari congratulated the Production War Room Team that anchored the production recovery process.“The team has done a great job in driving this project of not just production recovery but also escalating production to expected levels that are in the short and long terms acceptable to our shareholders based on the mandates that we have from the President, the Honourable Minister, and the Board,” Kyari explained. Giving details of the efforts of the Production War Room, the Chief War Room Coordinator, and Senior Business Adviser to the Group Chief Executive Officer, Mr. Lawal Musa disclosed that the feat was achieved through the collaborative efforts of Joint Venture and Production Sharing Contract partners, the Office of the National Security Adviser, as well as government and private security agencies.

He said the interventions led to the recovery of production cut across every segment of the production chain with security agencies closely monitoring the pipelines. He stressed that when the Production War Room team was inaugurated on the 25th June 2024, production was at 1.430mbpd, but the team swung into action, culminating into it sustaining the production recovery to 1.7mbpd in August and hitting the current 1.808mbpd in November.

“We are confident that with this same momentum and with the active collaboration of all stakeholders, especially on the security front, we can see the possibility of getting to 2mbpd by the end of the year,” he stated.

Also speaking on the development, Chairman of the NNPC Ltd Board of Directors, Chief Pius Akinyelure, who also congratulated the team, said he was happy to be part of the production recovery process, adding: “today, I will leave this place with my heart full of joy”.

He charged the Company’s Management to come up with a cashflow projection based on the new production figures to facilitate planning, stressing that he was looking forward to further production increase to 3mbpd.

-

Politics1 year ago

Politics1 year agoBREAKING: Abiodun emerges chairman of Southern Governors Forum

-

News1 year ago

News1 year agoZenith Bank Enhances Customer Online Experience with Revamped Digital Channels

-

News10 months ago

News10 months agoFirstBank holds groundbreaking ceremony for new 40-storey eco-friendly HQs in Lagos

-

News1 year ago

News1 year ago‘No Disparity,’ NUPRC Confirmed 1.8m bopd NNPC Ltd Oil Production Figures At NAPE Conference’

-

Business8 months ago

Business8 months agoZENITH BANK ASSURES SHAREHOLDERS OF QUANTUM LEAP IN FUTURE DIVIDENDS AT 34TH AGM, PAYS N195.67 BILLION FOR 2024 FINANCIAL YEAR

-

News9 months ago

News9 months agoFIRSTBANK FILES APPEAL

-

News1 year ago

News1 year agoUS indicts Air Peace CEO, Onyema, in fresh charges

-

Business9 months ago

Business9 months agoZENITH BANK ACHIEVES DOUBLE-DIGIT GROWTH IN GROSS EARNINGS, PROPOSES N4.00 FINAL DIVIDEND IN FULL YEAR 2024